Selling software to large organizations is quite different from selling to small businesses. Large companies have bigger budgets, more stakeholders involved in decisions, and longer buying processes. While a small business might sign a contract after two meetings, enterprise deals typically take over a year and involve a dozen or more people.

Companies selling to these large organizations face unique challenges. This guide shares proven ways to keep your pipeline healthy and avoid common slowdowns.

What is enterprise SaaS sales?

Enterprise SaaS sales involve selling cloud-based software to companies with 1,000 or more employees, with annual contract values typically ranging from $100,000 to $500,000 or more.

Unlike transactional sales, these deals require a hands-on, problem-solving approach. Sellers need to show clear results and real financial impact, often backed by data and a product walkthrough.

The sales process usually includes early discovery calls, a custom business case, product testing, contract discussions, and an onboarding plan. After a contract is signed, onboarding typically takes three to six months.

What challenges do sellers have to overcome in enterprise SaaS sales?

Enterprise sellers deal with three big challenges: fewer potential customers, lots of people involved in decisions, and buyers who are cautious about change.

Even top sellers struggle to get big changes started in this climate. You need support from people inside the company, not just a good pitch. When you build trust with champions in different departments and put together the business case together, the shift feels less risky and gets more traction.

Here are the specific challenges sales teams face:

Keeping a full pipeline

The pool of potential customers is smaller and more defined than in other markets. If you're targeting companies with more than 20,000 employees in the United States, you're working with a finite list.

For sellers focusing on specific verticals—higher education institutions, law firms, or professional services providers—the addressable market becomes even smaller. You might be working with just a few hundred truly qualified prospects.

Another pipeline challenge is contract timing. Enterprise SaaS contracts average at least a year in length, with larger companies often committing to a couple of years' agreements. Even if a prospect is interested in your solution, they might be locked into a current contract with a competitor.

Gartner reports that 64% of sales organizations update their strategy two or more times per year, which reflects how quickly enterprise pipeline assumptions change—renewal cycles, contract timing, and budget windows shift constantly.

Having your account executives note these contract windows helps with pipeline planning and forecasting. You can focus outreach efforts on companies whose contracts are ending or who are ready to evaluate new options, rather than those locked into agreements for another year at least.

Compelling decision-makers to take action

Enterprise buyers are cautious about large technology investments because they've seen—or heard about—expensive failures.

In this case, buyers also worry about whether the change will slow down the team or be hard for employees to learn. With these concerns top of mind, even strong sellers face resistance when proposing new technology.

Overcoming these objections means providing detailed implementation plans, risk mitigation strategies, and proof that the change is manageable.

Group decision-making adds another layer of complexity. With buying committees of 11 to 20 people, reaching consensus takes time. Account executives must work with internal champions—ideally multiple champions across different departments—handle this back-and-forth and help everyone align.

Sales expert Nate Nasralla recommends that sellers build the business case together with their internal supporters rather than presenting a pre-written proposal. This collaborative approach helps champions defend the decision internally and address objections from stakeholders the seller may never meet directly.

Creating custom collateral and proposals

Buyers now expect a smoother, more engaging experience when they evaluate products. Sales organizations failing to adapt will lose ground to competitors who can deliver online experiences that feel polished and easy to follow. The bar has been raised.

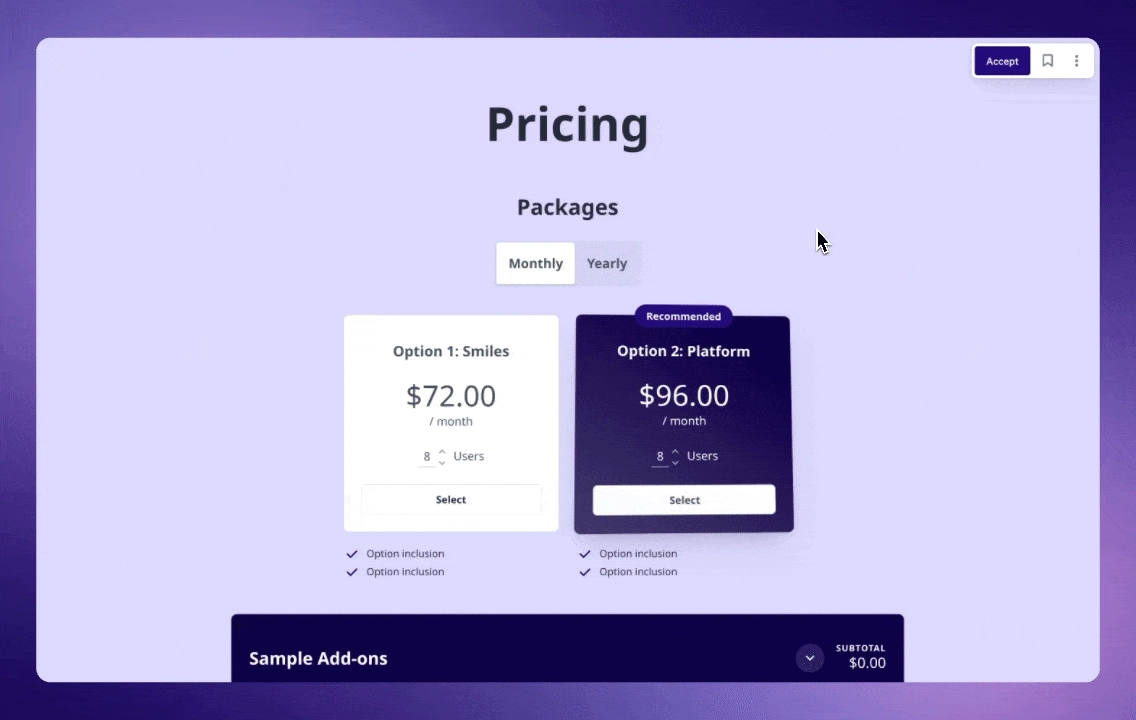

This is where modern proposal tools create differentiation. Instead of static PDF documents, sellers can create interactive proposal templates with embedded videos showing the product in action, pricing calculators that let prospects model different scenarios, and visual timelines demonstrating implementation plans.

Proposal software like Qwilr enables sellers to build these engaging experiences. For example, an interactive pricing calculator lets a prospect adjust user counts or feature tiers and see pricing updates in real-time.

Embedded videos can address common questions or showcase customer success stories without requiring another meeting.

These sales collateral also give prospects a feel for how your team works. If you're promising an excellent customer experience but delivering a plain PDF proposal, it sends mixed signals. An interactive, well-designed proposal shows prospects what working with you will actually feel like.

You can also find our enterprise sales proposal template below:

Beating the competition

The best way to stand out is to show what you do better than others in ways that matter to your buyers: specialized features, superior implementation support, proven ROI in specific industries, or exceptional customer success programs.

The enterprise SaaS market is growing rapidly and attracting intense competition. Fortune Business Insights' 2024 SaaS Market Report shows the global market was valued at $273.55 billion in 2024 and is projected to reach $908.21 billion by 2030—an 18.7% compound annual growth rate.

Competing on price alone rarely works in enterprise sales. Maintaining healthy margins is essential for investing in product development, customer support, and the infrastructure needed to serve large clients. Companies that discount heavily often can't afford the resources enterprise buyers expect.

Price-focused competition also creates a race to the bottom. If your only advantage is being the cheapest option, what happens when a competitor undercuts you?

Customers churn quickly since they seek whoever offers the lowest price or newest features. Enterprise sales adopt a short-term, price-focused approach instead of a long-term partnership.

How to establish an effective enterprise SaaS sales strategy

Building an enterprise SaaS sales strategy starts with defining your ideal customer and how you'll reach them. Before launching outbound campaigns to attract qualified leads or hiring more salespeople, clarify which enterprise clients you're best positioned to serve and what makes your solution uniquely valuable to them.

Identify your USP

Your USP explains what makes your product different and why certain customers should choose you.

An effective USP is specific, meaningful to your target buyers, and defensible. It should highlight concrete advantages, like deep knowledge of a specific industry, faster setup, or clear results backed by data.

For example, instead of claiming "better customer support," a strong USP might be "dedicated implementation managers with an average of 10+ years in healthcare IT who ensure HIPAA-compliant deployment within 90 days." This specificity helps the right prospects recognize you're built for their needs.

Narrow down your customer personas

Alongside your USP, develop detailed customer personas. These profiles bring your ideal customers to life—their roles, challenges, goals, and what factors matter most in their decision. Strong personas help sales and marketing teams write messaging that reflects how buyers make decisions.

A persona for an enterprise software buyer might include:

VP of Sales Operations at a 500-1,000 person B2B company, struggling with forecast accuracy across a distributed team, evaluated solutions based on Salesforce integration and user adoption rates, reports to the CRO, and needs to show ROI within two quarters.

When building your initial pipeline, use these personas to identify prospects with similar attributes. As prospects move through your sales pipeline, gather data on what messaging works, which objections come up most often, and what deal structures close fastest. Use these insights to refine your personas and improve your approach over time.

Create your sales playbook

A sales playbook gives your team a structured framework for moving prospects through the sales process. It ideally contains the questions to ask, objections to anticipate, and resources to share at each stage.

According to Gartner, only 55% of sales managers meet expectations—and 40% report feeling overwhelmed or burned out, which underscores why enterprise teams need structured playbooks and enablement programs that make the process easier to follow and reduce guesswork.

Here are the bare-bones resources for your sales playbook:

- Early-stage qualification: Start with discovery questions that help reps identify qualified opportunities. These questions reveal whether a prospect matches your ideal customer profile and screen out prospects who aren’t sending out buying signals.

- Proposal and presentation stage: The sales presentation includes case studies relevant to different industries or use cases, common sales objections with suggested responses, and deal structures that work for different buyer situations.

- Closing and onboarding: The playbook should contain everything needed to finalize deals, like contract templates, security questionnaires, onboarding checklists, and introduction processes for customer success teams

Post-sale engagement

Since enterprise customer relationships are long-term, include a schedule for customer touchpoints: 30-day check-ins to troubleshoot technical issues, quarterly business reviews to show ROI with usage data, and annual strategic planning sessions to align on the customer's upcoming initiatives.

Learn how to structure these reviews for maximum impact in our QBR guide.

Structure your SaaS sales team

The right team structure depends on your deal size, sales cycle length, and target market. Here are the core roles most enterprise SaaS teams need:

- Sales leaders: Responsible for strategy, forecasting, and coaching. They work with reps to improve performance, remove obstacles, and provide executive-level support on major deals.

- Account Executives (AE): These reps own the full sales cycle from qualified lead to closed deal. They conduct discovery, run demonstrations, negotiate contracts, and hand off new customers to the success team.

- Sales Development Representatives (SDR): SDRs focus on outbound prospecting and lead qualification. They research accounts, conduct initial outreach, and schedule meetings for AEs. This specialization lets AEs focus on deals most likely to close while SDRs keep the pipeline full.

- Sales operations: This team manages the tech stack (CRM, forecasting tools, proposal software), builds reports and dashboards, and ensures data quality. They bridge sales and marketing, helping both teams work from the same information.

- Sales enablement: Enablement teams create training programs, maintain the sales playbook, develop pitch decks and demo environments, and onboard new hires. They ensure the entire sales organization has the sales enablement tools needed to succeed.

- Sales support (optional for larger teams): Administrative professionals handle scheduling, travel coordination, proposal formatting, and CRM updates—freeing AEs and leaders to focus on selling and strategy.

The size of each function depends on your business. A company with five AEs might need one sales leader and three to five SDRs. A 50-person sales organization might have dedicated operations, enablement, and admin teams.

Keep track of performance with sales metrics

Sales leaders need visibility into both activity metrics (what reps are doing) and outcome metrics (what's actually closing) to identify problems early—like reps spending time on unqualified leads, deals stalling at specific pipeline stages, or win rates dropping in particular market segments—and improve sales performance.

Key metrics to track

Activity metrics

- Outbound calls and emails sent

- Meetings scheduled and completed

- Demos delivered

Pipeline metrics

- Number of qualified opportunities by stage

- Total pipeline value vs. quota

- Average deal size

- Time spent in each stage

Outcome metrics

- Average sales cycle length

- Quota attainment by rep

- Customer acquisition cost

- Win rate (deals won / total opportunities)

Retention metrics

- Churn rate (monthly and annual)

- Net revenue retention

- Customer satisfaction scores (CSAT or NPS)

You can use a sales compensation management tool, like QuotaPath, to enable reps to forecast their earnings according to their pipeline.

Different metrics matter at different organizational levels. For example, SDRs track meetings booked and lead quality, account executives track pipeline value and win rates, and Sales leaders track quota attainment and forecast accuracy.

Sales methodologies to complement your enterprise GTM

Sales methodologies provide frameworks for navigating complex sales, but they're not one-size-fits-all solutions. The approach you choose should depend on your product, market position, and sales cycle length. Adopting a structured sales approach can help shorten sales cycles and improve win rates. Here are four SaaS sales methodologies that work well for enterprise deals:

The Challenger Sales Methodology

Challenger Sales teaches reps to challenge prospects' assumptions about their business and current approach. Rather than simply responding to stated needs, reps guide prospects to recognize problems they might not have fully understood.

The methodology works through teaching, tailoring, and taking control. Reps teach prospects something new about their business or industry, tailor the message to the prospect's specific situation, and take control of the sales conversation, including pushing back when necessary.

It works best for complex enterprise deals where buyers need education about industry trends, hidden costs of their current approach, or innovative solutions they haven't considered. It's less effective for straightforward product comparisons or price-driven purchases.

Gap Selling

Gap Selling focuses on identifying the difference between a prospect's current state and their desired future state. The "gap" represents the problems, costs, and missed opportunities that exist today versus what could be possible with the right solution.

Sales reps using this methodology spend significant time understanding the current situation:

- What processes are manual?

- What's the cost of inefficiency?

- What opportunities are being missed?

Then they help prospects envision the future state and quantify the value of closing that gap.

For example, if a prospect's sales team spends 10 hours per week on manual data entry, a Gap Selling approach would calculate the cost (10 hours × 50 reps × $75/hour = $37,500 weekly), explore the impact on morale and forecast accuracy, then demonstrate how automation could eliminate 80% of that work. The rep shows the tangible business value of implementation.

MEDDPICC

MEDDPICC is a qualification framework designed for complex enterprise sales with multiple stakeholders and long cycles.

The acronym stands for:

- Metrics - Quantifiable value the customer expects

- Economic Buyer - Person with budget authority

- Decision Criteria - How the organization evaluates solutions

- Decision Process - Steps required to reach a decision

- Paper Process - Legal, procurement, and contracting requirements

- Identify Pain - Business problems driving the purchase

- Champion - Internal advocate promoting your solution

- Competition - Alternative solutions being considered

Account executives must identify and document each element before advancing deals through the pipeline. This rigor prevents surprises late in the sales cycle like discovering a stakeholder you didn't know about or learning the decision process takes six months longer than expected.

MEDDPICC helps sales leaders forecast more accurately by ensuring reps truly understand deal dynamics before marking opportunities as "likely to close."

Proof of Concept Sales

Proof of Concept (POC) methodology involves showing that your solution actually works for a prospect's specific use case before they commit to a purchase. This is especially common in technical sales where buyers need confidence that your suggested enterprise software integrates with their systems or handles their data volume.

A successful POC starts with clear success criteria agreed upon by both parties.

- What specific outcomes need to be demonstrated?

- What timeline?

- Who evaluates the results?

Without this alignment, POCs can drag on indefinitely without leading to decisions.

POCs carry risk—they require time and technical resources without guaranteed returns. Most companies reserve them for qualified, high-value opportunities where technical validation is the primary obstacle to closing.

Using a different sales methodology, and curious how your sales enablement collateral can reinforce your enterprise SaaS motion? Check out some of our recently created templates, including MEDDIC, Spin Selling, and BANT.

Creating a repeatable sales strategy for enterprise SaaS sales success

Enterprise sales require personalization, but that doesn't mean reinventing the wheel for every deal. Successful teams build repeatable processes supported by templates and frameworks that can be customized for each customer.

Buyers need to see the ROI they can expect and how you’ll guide them through implementation. These details should be documented in proposals, plans, and business cases that buyers can share internally.

Interactive proposals with videos, calculators, and timelines hold attention far better than static PDFs. Qwilr lets teams create these pages and see which sections stakeholders view, making it easier for reps to tailor their follow-ups.

Want a proof of concept to show this will work for you and your team? Schedule a demo, and we’ll gladly walk you through it.

About the author

Kiran Shahid|Content Marketing Strategist

Kiran is a content marketing strategist with over nine years of experience creating research-driven content for B2B SaaS companies like HubSpot, Sprout Social, and Zapier. Her expertise in SEO, in-depth research, and data analysis allow her to create thought leadership for topics like AI, sales, productivity, content marketing, and ecommerce. When not writing, you can find her trying new foods and booking her next travel adventure."